Welcome to an innovative funding option for property developers seeking to raise external capital for their next project.

Rawlings Bolton & Co understands the challenges property developers face in securing capital for their projects. That’s why we advocate for a strategic approach that leverages managed investment schemes (MIS) by utilising the authorisation of our Australian Financial Services License (AFSL 27444).

Here, we’ll:

- explore the benefits of using an MIS;

- outline the advantages over traditional bank financing; and

- lay out how Rawlings Bolton can assist you on this journey.

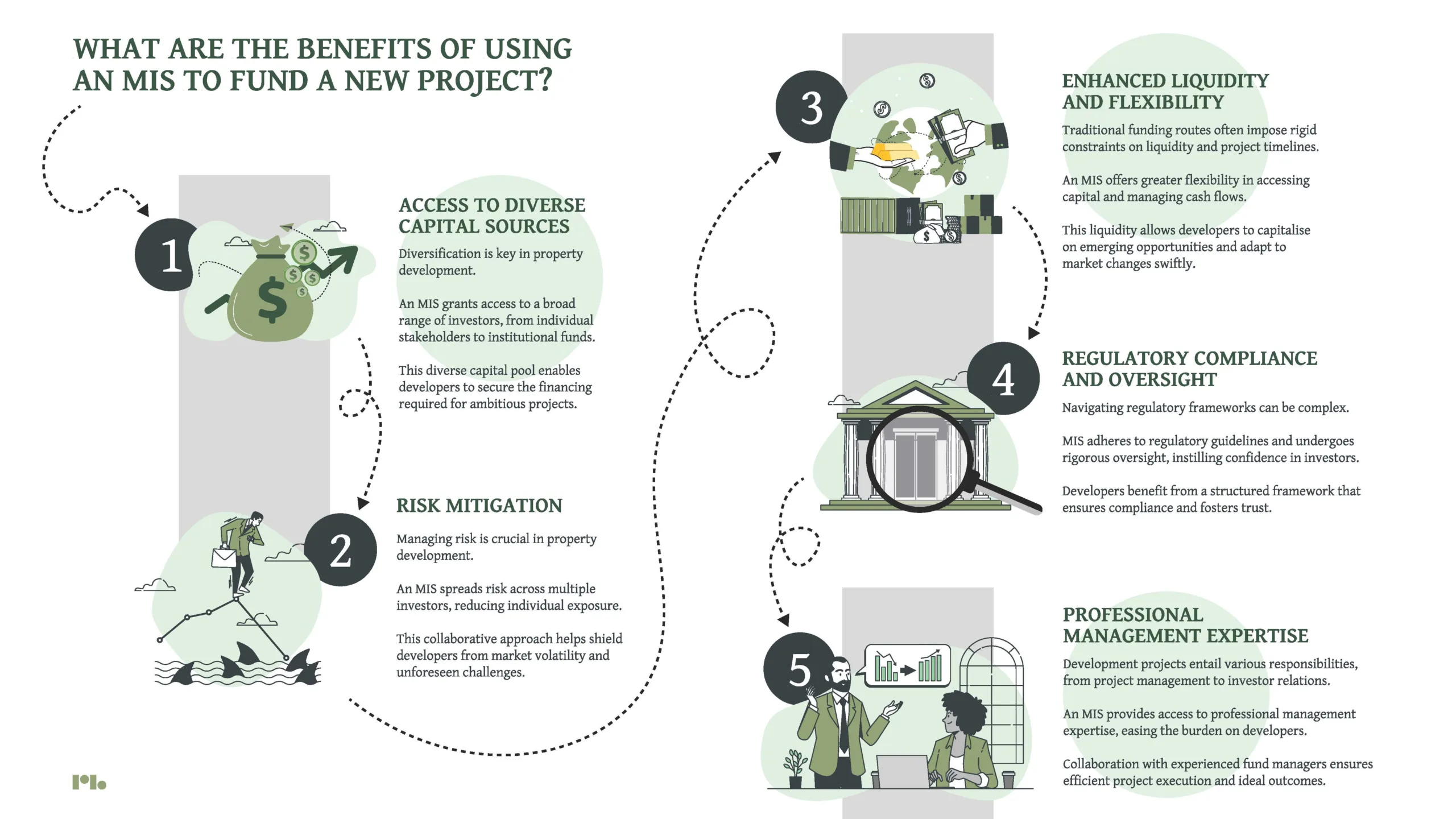

What are the benefits of using an MIS to fund a new project?

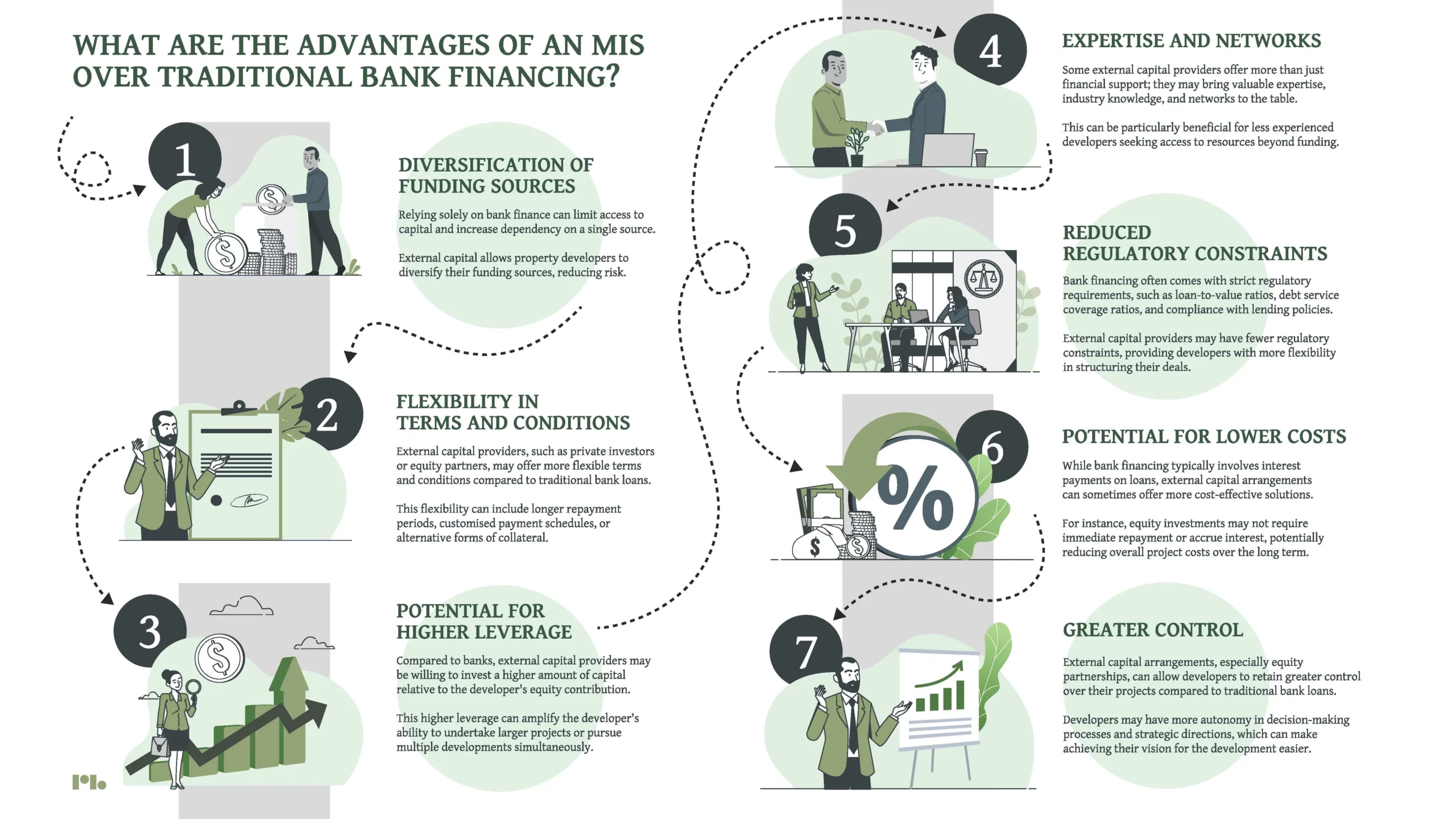

What are the advantages of an MIS over traditional bank financing?

How can Rawlings Bolton support you through this process?

- Structuring managed investment schemes

Rawlings Bolton specialises in crafting tailored MIS structures that align with the unique needs and objectives of property developers. By leveraging our expertise, developers can access a diverse pool of investors and secure the necessary capital to fuel their new projects.

- Regulatory compliance and due diligence

Our team at Rawlings Bolton ensures that all MIS activities adhere to stringent regulatory standards and undergo thorough due diligence processes. By navigating complex regulatory frameworks with precision, developers can be assured that their fundraising efforts remain in full compliance with applicable laws and regulations.

- Investor relations management

Effective communication with investors is paramount to the success of any MIS. Rawlings Bolton facilitates transparent and open dialogue between developers and investors, fostering trust and confidence in the fundraising process. By maintaining strong investor relations, developers can cultivate long-term partnerships and secure ongoing support for their projects.

- Corporate governance oversight

As trustee of the MIS, Rawlings Bolton assumes responsibility for upholding robust corporate governance standards. We implement comprehensive governance frameworks, ensuring transparency, accountability, and ethical conduct throughout the fundraising process. Developers can rely on our expertise to safeguard investor interests and maintain the integrity of their projects.

- Risk management strategies

Rawlings Bolton employs advanced risk management techniques to identify, assess, and mitigate potential risks associated with MIS investments. By proactively managing risk exposure, developers can protect their projects and enhance investor confidence in the fundraising endeavour.

- Ongoing monitoring and reporting

Our team provides ongoing monitoring and reporting services to track the performance of the MIS and ensure compliance with established objectives. Developers receive timely updates and insights into the progress of their fundraising efforts, empowering them to make informed decisions and adapt strategies as needed.

- Expert guidance and support

Throughout the fundraising process, Rawlings Bolton offers expert guidance and support to developers, drawing on our extensive experience in property development finance. Whether by navigating regulatory requirements or addressing investor concerns, developers can rely on our dedicated team to provide strategic counsel and practical solutions.

In conclusion, managed investment schemes offer property developers a compelling alternative for securing capital for their projects. With benefits such as access to diverse capital sources, risk mitigation, enhanced liquidity, and regulatory compliance, an MIS presents numerous advantages over traditional bank financing.

At Rawlings Bolton & Co, we specialise in structuring managed investment schemes tailored to developers’ needs. Our services include regulatory compliance, investor relations management, corporate governance oversight, risk management strategies, ongoing monitoring, and expert guidance throughout the fundraising process.

For more information on how Rawlings Bolton & Co can support your project with MIS, please contact us. We look forward to assisting you in achieving your development objectives.

This information is intended to be general in nature and is not personal financial product advice. It does not consider your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided having regard to your objectives, financial situation and needs.

This information has been provided for informational purposes only and should not be construed as investment advice or an offer to invest in any investment vehicle.