Managed investment schemes are a dynamic and accessible avenue for investors to pool their funds and gain exposure to a diversified range of assets that are managed by experienced professionals. These popular schemes provide individuals with access to a wide range of investment opportunities that they might not be able to access by themselves.

Let’s take a look at how managed investment schemes function within the investment landscape by shedding light on their features and benefits.

What is a managed investment scheme?

A managed investment scheme (MIS) – often classified as a collective investment scheme in international markets – is a type of investment structure where:

- Money is pooled from multiple investors, each potentially targeting different types of asset classes.

- Collective funds are managed by a responsible entity (RE), who is legally empowered and obligated to oversee the operation of the scheme. The RE makes key investment decisions on behalf of all the participants.

- Each investor holds ‘interests’ in the scheme (akin to shares) but does not have day-to-day control over the management of it.

The pooled funds may be invested across a single asset class or a diversified portfolio of assets, which may include stocks, agribusiness, real estate, and commodities, depending on the scheme’s investment objectives.

In Australia, managed investment schemes are regulated by the Corporations Act 2001 and overseen by the Australian Securities and Investments Commission (ASIC), ensuring investors’ interests are thoroughly safeguarded.

Why use a managed investment scheme?

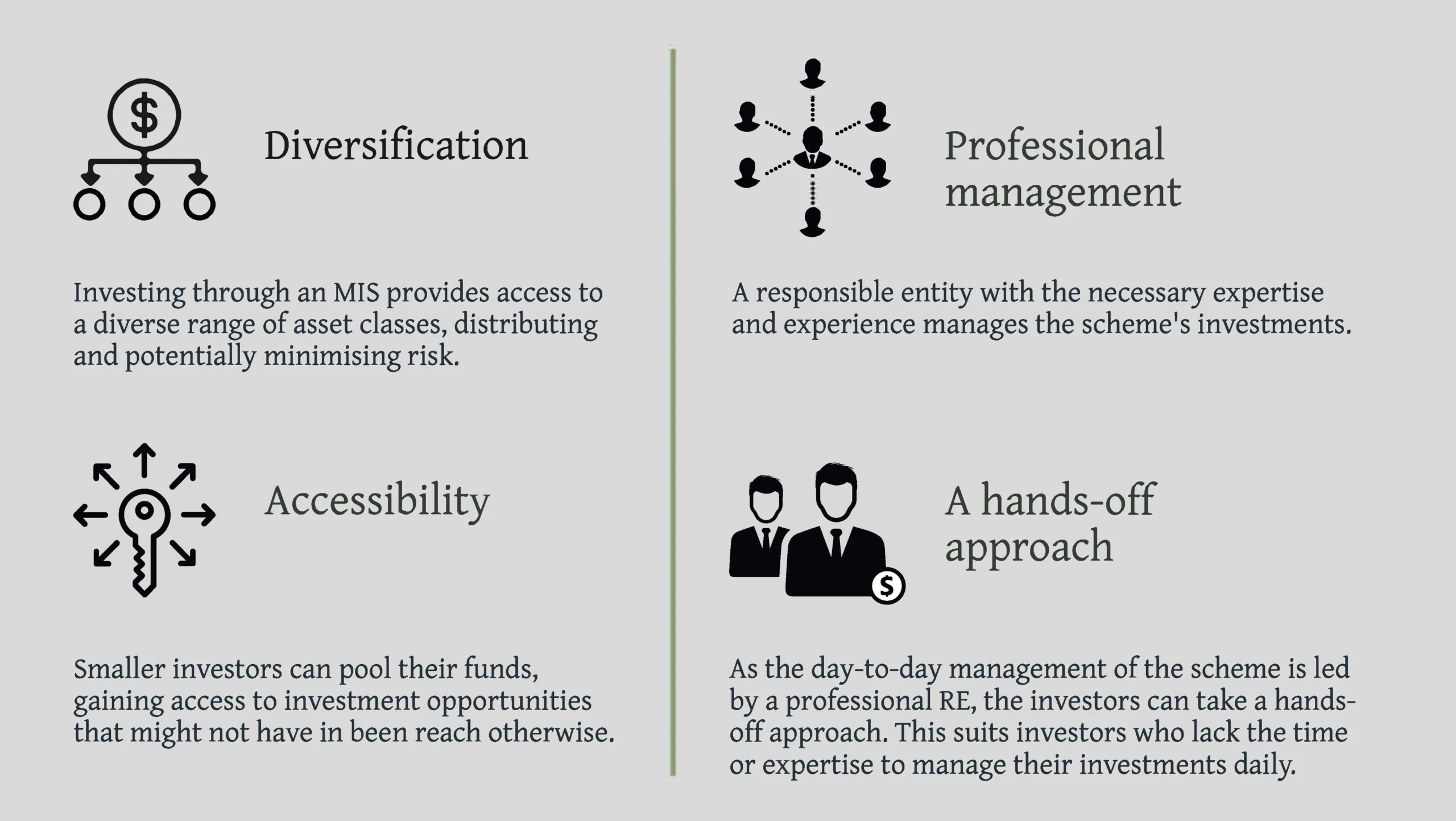

Managed investment schemes offer these benefits to individual and institutional investors:

Key features of managed investment schemes

Professional management: One of the fundamental features of a managed investment scheme is that it is managed by experienced professionals. Skilled fund managers or investment teams make strategic decisions on behalf of the investors, aiming to achieve the scheme’s stated objectives.

Diversification: Investors are exposed to a variety of assets, reducing the risk associated with concentrating investments in a single asset or market. Diversification mitigates the impact of poor performance in any one asset class.

Liquidity: Some managed investment schemes offer liquidity, allowing investors to buy or sell their units in the scheme on a regular basis, typically daily. This flexibility enhances an investor’s ability to access their funds when needed. Schemes may also offer period distribution payouts to investors at the discretion of the investment manager.

Investment objectives: Managed investment schemes have specific investment objectives that guide its strategies. These objectives could include capital growth, income generation, capital preservation, or a combination of these goals. The investment approach is aligned with the scheme’s stated objectives.

Risk profile: Managed investment schemes disclose their risk profiles to investors. Different schemes carry varying levels of risk, depending on factors such as the types of assets held, market volatility, and investment strategies. Investors should carefully assess the risk profile to ensure it aligns with their risk tolerance.

Units or shares: Units or shares are issued to investors that represent their ownership in the scheme. The value of these units or shares is linked to the performance of the scheme’s underlying assets.

Affordability: Investors with relatively small amounts of capital can access professionally managed portfolios that would otherwise require a substantial investment.

Transparency: The responsible entity provides investors with clear and accurate information about the scheme’s operations, investment strategies, fees, and risks. Investors can make informed decisions based on this transparency.

Taxation implications: Managed investment schemes may have taxation implications for investors. This includes considerations related to distributions, capital gains, and tax-effective investing strategies. It’s important for investors to understand the potential tax implications of participating in a scheme.

Regulatory oversight: Managed investment schemes are subject to regulatory oversight by relevant authorities, such as the Australian Securities and Investments Commission (ASIC) in Australia. This oversight helps ensure that the scheme operates within established legal and regulatory frameworks.

These key features play a crucial role in shaping the structure and functioning of these investment vehicles. It’s essential to understand these features before participating in a managed investment scheme to make informed investment decisions aligned with your financial goals and risk tolerance.

Types of managed investment schemes

In summary, a managed investment scheme is an enticing option for smaller investors looking for access to professional management, diversification, and the potential for favourable returns.

How can we help?

We are flexible and offer tailored fund administration and registry solutions to clients. We are happy to work with all types of investment managers, whether they’re launching their first fund or are more experienced with an established track record.

Contact Stav Sotiriou today at [email protected] for a confidential discussion and possible solutions for your business.